Table of Contents

Overview

Any prospective Business Analyst (BA) hoping to work in the financial industry must have a solid understanding of the trade lifecycle in capital markets. Every phase of the lifecycle, from the creation of pre-trade orders to post-trade reporting and reconciliation, has technological, operational, and regulatory implications. This article outlines the eight main phases of the trade lifecycle, describes the common systems used, and identifies important factors that every business analyst should be aware of when working on capital market projects.

This guide will help you understand how trade flows across front-, middle-, and back-office systems—and why mapping these processes is essential for providing smooth, compliant, and high-performance trading solutions—whether you’re transitioning into finance or expanding your domain expertise.

If you’re looking to deepen your practical understanding of the trade lifecycle, explore our comprehensive Capital Market Domain Training Course designed for aspiring Business Analysts.

Want to learn how Business Analysts add value in financial projects? Read our in-depth guide on the Capital Market Business Analyst role for real-world insights.

1. Why the Trade Lifecycle Matters to a BA

Projects in capital markets rarely live in silos. A small tweak in the trading engine can impact the risk systems, regulatory reporting, and even client billing. Mapping the trade lifecycle in capital market forces you to:

- See interdependencies. You’ll spot where front-office changes ripple into back-office headaches.

- Speak everyone’s language. Traders care about milliseconds, ops teams care about breaks, compliance cares about flags. A life-cycle view acts as your universal translator.

- Prevent “Oops, we forgot…” Miss a single event (say, corporate actions), and your system could misprice positions—expensive mistake.

Think of the trade lifecycle in capital market as a story arc. Every actor—trader, matching engine, clearing broker—enters at the right chapter. As the BA, you’re the narrator who ensures readers never get lost.

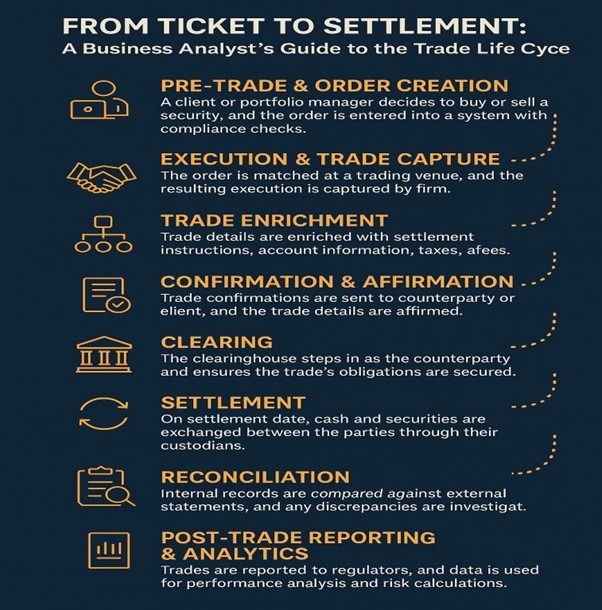

2. The Eight Core Stages

2.1 Pre-Trade & Order Creation (Front Office)

What happens:

A portfolio manager or retail client decides to buy or sell a security. They punch the order into an Order Management System (OMS) or trading app. Compliance checks fire instantly. Understanding this stage is vital to mapping the trade lifecycle in capital market.

BA watch-outs:

- Rule engines: Where will limit checks live—inside the OMS or a separate service?

- Data fields: Capture intended trade date/time, instrument identifiers, order type (market/limit), and client classification.

- Latency requirements: Equity desks might demand microseconds, while fixed-income teams shrug at seconds.

2.2 Execution & Trade Capture

What happens:

The order hits a venue—stock exchange, alternative trading system, or dark pool. A match occurs. The execution venue returns fills (partial or complete) to the firm.

BA watch-outs:

- Trade ID schema: Will you rely on the venue’s execution IDs, your own internal IDs, or both?

- Partial fills and “child orders”: Your workflow must handle one order spawning multiple trades.

- FIX protocol mapping: If your system parses FIX messages, define which tags feed downstream apps.

2.3 Trade Enrichment (Middle Office)

What happens:

Raw executions lack context. Middle-office systems enrich trades with settlement instructions, account codes, taxes, fees, and counterparty details.

BA watch-outs:

- Static data sources: Where do you pull Standing Settlement Instructions (SSIs)—a golden source or a maintenance nightmare Excel?

- Time zones & calendars: Holidays differ across markets; a T+1 in the India might be T+2 for other countries’ equities.

- Enrichment rules traceability: Document every “if/then” so auditors don’t hunt you down later.

If you’re looking to deepen your practical understanding of the trade lifecycle, explore our comprehensive Capital Market Domain Training Course designed for aspiring Business Analysts.

Want to learn how Business Analysts add value in financial projects? Read our in-depth guide on the Capital Market Business Analyst role for real-world insights.

2.4 Confirmation & Affirmation

What happens:

Firms send trade confirmations to counterparties or clients—electronically via SWIFT or PDFs. Both parties affirm details: price, quantity, currency, settlement date. At this point in the trade lifecycle in capital market, accuracy and audit trails become critical.

BA watch-outs:

- Break management: Define states—pending, matched, mismatched—and SLAs for resolution.

- Digital signatures vs. e-mail approvals: Legal loves clarity; pick one method.

- Versioning: A corrected confirm must not overwrite the original; create an audit trail.

2.5 Clearing

What happens:

Clearinghouses step in as the buyer to every seller and the seller to every buyer. They require margin and guarantee settlement.

BA watch-outs:

- Margin calculations: Where do they run? Front-office risk or clearing gateway?

- Netting logic: Will your system net buys and sells across the same CUSID and settlement date?

- Regulatory hooks: SEBI rules may dictate file formats and reporting times.

2.6 Settlement (Back Office)

What happens:

On settlement date (T+1), custodians exchange securities and cash via delivery-versus-payment (DvP).

BA watch-outs:

- Status updates: Real-time SWIFT MT54x messages? Batch files every hour? Decide early.

- Fails & buy-ins: Model scenarios where settlement fails and a mandatory buy-in kicks in.

- Multi-currency payments: FX conversions may create extra trades— don’t ignore them.

2.7 Reconciliation

What happens:

Ops teams compare internal books against custodian or prime broker statements. Breaks trigger investigations. Reconciliation is a core part of the trade lifecycle in capital market, ensuring transparency and error detection.

BA watch-outs:

- Matching keys: Trade date vs. settle date, gross vs. net amounts— define precedence to cut false breaks.

- Tolerance levels: A 0.01 difference—ignore or escalate?

- Dashboard metrics: Decide which KPIs (aging breaks, break count by counterparty) will surface to management.

2.8 Post-Trade Reporting & Analytics

What happens:

Firms report trades to regulators (SEBI Transaction Reporting). Performance teams analyze P&L attribution. Risk calculates VaR.

BA watch-outs:

- Reg report templates: Hard-code XML schemas or produce configurable mappings?

- Historical data retention: Five years? Seven? Storage costs vs. compliance fines—trade-off alert.

- Data lineage: Auditors will ask, “Which upstream field fed ISIN in your report?” Document lineage upfront.

If you’re looking to deepen your practical understanding of the trade lifecycle, explore our comprehensive Capital Market Domain Training Course designed for aspiring Business Analysts.

Want to learn how Business Analysts add value in financial projects? Read our in-depth guide on the Capital Market Business Analyst role for real-world insights.

3. Typical Systems in the Ecosystem

The table below aligns key systems with their roles in each stage of the trade lifecycle in capital market. For a Business Analyst, knowing these system touchpoints is vital for successful project delivery.

| Life-Cycle Stage | Common System Names | What to Ask as a BA |

|---|---|---|

| Pre-Trade | OMS, Compliance Engine | “Which rules execute synchronously vs. asynchronously?” |

| Execution | EMS, Smart Order Router | “Do we support algorithmic routes, or only direct market access?” |

| Enrichment | Trade Management System (TMS) | “Who owns reference data quality—ops or IT?” |

| Confirmation | CTM, SWIFT Gateway | “How do we handle counterparties not on CTM?” |

| Clearing | CCP Gateway | “Is margin posted automatically via SWIFT or manual?” |

| Settlement | Custody Platform | “Do we need multi-custodian netting?” |

| Reconciliation | Recs Tool | “What’s our target break resolution time?” |

| Reporting | Regulatory Hub, Data Lake | “How do schema changes propagate—CI/CD or weekend war room?” |

Conclusion

Every part of the trade lifecycle in the capital market, from pre-trade to post-trade reporting, gives a Business Analyst useful information. You not only learn about process flows by mastering this lifecycle, but also how systems, stakeholders, and compliance work together.

If you’re looking to deepen your practical understanding of the trade lifecycle, explore our comprehensive Capital Market Domain Training Course designed for aspiring Business Analysts. Want to learn how Business Analysts add value in financial projects? Read our in-depth guide on the Capital Market Business Analyst role for real-world insights.

FAQs for Aspiring BAs in Capital Markets

Q. What is a trade lifecycle?

A trade lifecycle is the end-to-end process a trade goes through, from its initial idea to final settlement. It’s a critical concept in capital markets that ensures every transaction is executed, confirmed, cleared, and settled accurately.

Q. Why is understanding the trade lifecycle important for a Business Analyst?

Understanding the trade lifecycle for BAs is essential because it helps them map business processes, identify system dependencies, and understand the flow of data. This knowledge is crucial for a BA to effectively work on projects in the capital markets domain.

Q. What are the main stages of the trade lifecycle?

The main stages of the trade lifecycle include the pre-trade phase (research and order creation), trade execution, confirmation, clearing, and settlement. The cycle concludes with post-trade activities such as reconciliation and reporting.

Q. How does a Business Analyst contribute to each stage of the trade lifecycle?

A BA’s contribution spans the entire trade lifecycle. They are involved in gathering requirements for trading platforms, analyzing business needs to improve efficiency, and ensuring that technological solutions align with the flow of a trade from the front to the back office.

Q. What is the difference between clearing and settlement?

Clearing is the process of validating and finalizing the terms of a trade before it is settled, often managed by a clearinghouse. Settlement is the final stage where the actual transfer of securities and funds between the buyer and seller takes place.

Q. What are the key IT systems involved in the trade lifecycle?

Various IT systems are involved in the trade lifecycle. These include front-office systems for order management, middle-office systems for risk and compliance, and back-office systems for clearing, settlement, and accounting.

Q. How can I learn about the trade lifecycle to become a BA?

You can gain expertise by taking specialized courses that cover the capital markets domain and the trade lifecycle for BAs. These courses provide a detailed understanding of the process and the business analysis techniques used in this field.