In this post, we are going to write about the Trade finance domain. This will get you started with the basics and key products of trade finance.

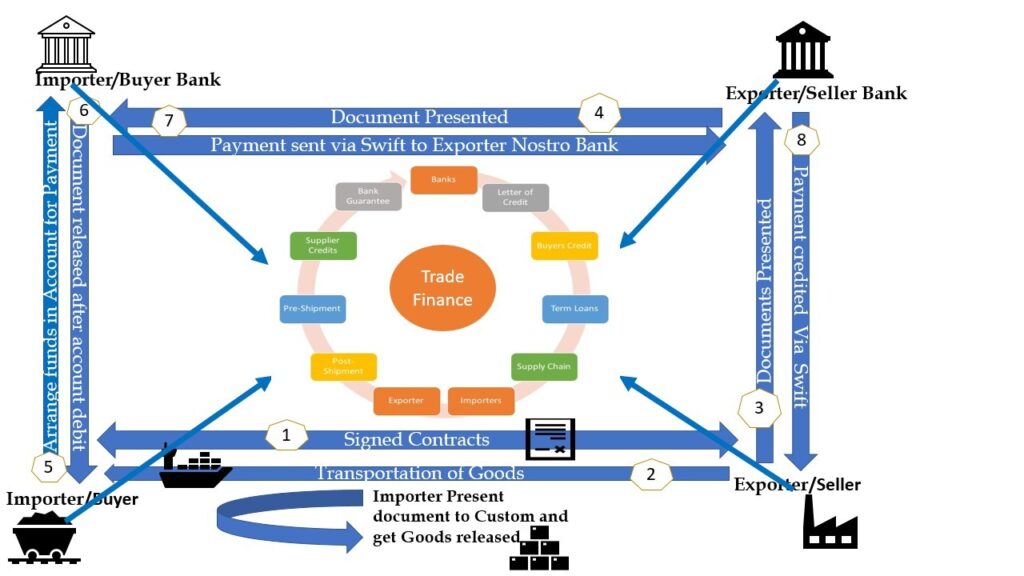

What is Trade Finance? Trade Finance is all about the financial mechanisms that support trade deals between importers and exporters. It facilitates the purchasing power of importers and mitigates risks for exporters. Trade Finance acts as a backbone for buyers and sellers, whether in local or international markets.

The Trade Finance providers are Finance houses, Banks, Suppliers, Buyers, Syndicates, Non-Banking Finance Co-operation {NBFC}, etc. Amongst all these, the Banks play a pivotal role by providing finance to buyers and sellers. They offer various products and services that support buyers in getting their products and services delivered and sellers to get paid for their products/services. As stated above, The Banks offer numerous financing facilities to importers and Exporters.

Key Trade finance documents and products

Some of the key documents and products used in trade finance are as follows:

- Letter of Credit [LC]

- Bank Guarantees [BG],

- Post-shipment [PSFC] and Pre-shipment [PCFC],

- Discounting of Bills,

- Overdraft Facilities,

- Term Loan,

- Working capital Loans,

- Buyers and Suppliers Credit, and

- Supply Chain Finance.

A brief description of some of the key finance products, which are crucial in understanding what is trade finance, is discussed in the next few sections

Letter of Credit [LC]

It’s a commitment provided by the Bank based on specific terms and conditions in the form of a Letter agreed upon between the Bank, Buyer, and Seller. It is the most widely used funding tool that promises to pay the specified amount on a specific due date to the seller on behalf of the buyer. There are multiple types of LCs. The types of LCs are listed below:

- Revocable or Irrevocable LC,

- Transferrable or Non-Transferrable LC,

- Red or Green clause LCs,

- Confirmed or Un-Confirmed LCs,

- Revolving and Non-Revolving LCs,

- Sight or Usance and

- Back to Back LCs.

Bank Guarantee [BG]

As the name suggests, this product is all about a Bank agreeing to guarantee payment to the relevant party in case of breach of contract. It is a contractual obligation among three parties, i.e. Bank, Applicant, and the Beneficiary.

LC and BGs are not the same. In LC payment is made on the basis of the delivery of goods and services, whereas in BG’s payments are made if the obligation is failed by any of the parties.

BGs exist in various forms such as Financial, Performance, Bid Bond, Shipping Guarantees, Customs, etc.

Buyers and Supplier Credits

A key aspect of what is trade finance is the loan facility in foreign currency taken for a short period to make payments to overseas sellers for imports of goods and services. This process involves buyer’s credit, which is arranged by importers through overseas banks, and supplier credits, which are extended by overseas suppliers. This funding methodology is essential in international trade, facilitating smooth transactions between global partners.

Supply Chains Finance

It is a commonly used financing technique by Banks in the Local market i.e., within the country. It is financing with or without recourse to vendors or dealers in advance on the basis of the Bill of Exchange i.e., Hundi and Invoices. The types of supply chain financing are:

- Channel financing,

- Vendor Financing,

- Sales or Purchase Invoice discounting,

- Bills discounting, etc.

Pre-shipment and Post shipment

Pre-shipment facility, also known as Packing Credit in foreign currency (PCFC), is a loan provided to exporters for manufacturing, procuring materials, and packing goods to enable their export. In the context of what is trade finance, this facility plays a crucial role in facilitating exports. Conversely, post-shipment facilities are short-term loans given to exporters against goods that have already shipped, allowing them to manage day-to-day working capital and address cash liquidity crunches while awaiting payments from importers.

Other Loans/Products

It is provided in various forms such as Cash Credit facility / Overdraft facility / Working capital and Term Loans. These help buyers and seller manage their daily cash activities and working capital requirements. These loans are provided on the basis of fixed, floating, Mibor, Libor, BPLR, PLR, and MCLR, etc. interest rates prevailing in the market and payment scheduled through interest and Principal plus down payment forms.

Conclusion

In conclusion, what is trade finance? It is essential to international trade, enabling the movement of commodities and services across national boundaries. A thorough understanding of trade finance is becoming increasingly important as companies broaden their presence in the international market. Whether you’re an experienced professional or just starting out in the realm of international trade, grasping the nuances of what is trade finance can be a game-changer.